The Amazon Go model is gaining momentum and new technologies that monitor customers and products are changing the shopping experience

With the checkout-free shop we are witnessing the third shopping revolution. For decades, the purchase of goods and products in supermarkets has remained unchanged, but now innovations are arriving that will revolutionize the shopping experience and the relationship with shop assistants. Although contemporary society is immersed in technology and therefore accustomed to the transformations that the birth and development of new services generate on production processes and related activities, the impact in the short and medium term is expected to be similar to what happened after the middle of the first decade of the 20th century. It was in September 1916 that Piggly Wiggly was opened in Memphis, Tennessee (USA), which went down in history as the world’s first supermarket where customers could walk around the aisles and choose the products they wanted to buy themselves. Clarence Saunders, the store’s big boss, was inspired by the need to save on operating costs, which allowed him to reduce the cost of products and thus secure more revenue.

The aim pursued by Saunders is not the priority that prompted Amazon to create the first supermarket without checkouts and with cashiers responsible for stocking shelves and assisting customers, because a giant that closed the last quarter of 2021 with revenues of $137.41 billion and profits of $14.32 billion is not looking to save money but to experiment with new services. Especially if, after paving the way and setting out to scatter the United States with physical supermarkets, it has decided to sign partnerships to sell its technology to other players in the sector. Entering an Amazon Go means wandering around a supermarket and filling the baskets with the products you want and then leaving without waiting in line and stopping at the checkout, since the credit card connected to the Amazon app pays for it. Also because, as well as saving time, it allows you to buy whatever you want, leaving your wallet at home and without having a penny in your pocket.

As always, the company is more interested in data and users’ spending and purchasing habits than in the size of the investment. To get an idea of the progress made since 2018, it is enough to know that the cost of the technology behind an Amazon Go shop has been reduced from $4 million to $159,000. The substantial drop has convinced the company led by Andy Jassy, heir on the bridge of the founder Jeff Bezos, to continue the advance of physical stores (which goes hand in hand with the expansion of Amazon Fresh and the maintenance of the network of Whole Foods Market shops, an organic food chain that Amazon acquired in 2017 for $13.7 billion). Initially conceived only for large metropolises such as Chicago, San Francisco and New York, the multinational company’s next step will be to open small Amazon Go supermarkets in the suburbs, not least because the growth of smart working following the spread of Covid-19 has changed the game, with workers still spending more time at home than at their desk in the office.

One example is the supermarket to be opened in Mill Creek, a town of 20,000 inhabitants near Seattle. Indeed, customers will be able to count on larger stores than in the past (increasing from 100-200 square meters to 550), in which everyone will enter by passing a cooker through the scanning of a QR code and will move freely while the customers’ movements will be filmed by hundreds of mini cameras installed on the ceiling of the structure. Together with sensors, deep learning and computer vision, the cameras represent the central elements of Just Walk Out, the technology used by Amazon that allows it to recognise the products placed in the shopping cart (without any scanning or other action) and also detect those chosen and subsequently put back on the shelf. Each item and fresh product (available in Amazon Go Grocery) will then be visible on the app, in the ‘your orders’ section, along with purchases made online.

The wide range of tools aimed at monitoring customers’ moves have inevitably come under criticism from those who put the protection of privacy ahead of the usefulness of the service. However, Amazon has repeatedly made it clear that it does not use facial recognition, specifying that the cameras are aimed at the products and not at the people inside the supermarket. The ease of the installation process, which takes a few weeks and includes training of retailers (who are no longer cashiers but service and replenishment staff) to make customers’ lives easier, combined with the possibility of exploiting the technology in many different sectors that have in common high demand and long queues, has sparked interest in Just Walk Out. Amazon’s technology is in fact used by several partners, such as Resorts World Las Vegas, Boston’s TD Garden arena, Levy restaurants and markets in Hudson, Delaware North and Cibo Express.

The path opened up by Amazon has also triggered a large-scale process of similar solutions aimed at creating shops without checkouts and cashiers: a goal that unites large giants such as Walmart and Macy’s with small happy islands such as the Universities of Houston and San Jose, with the latter relying on the camera system of StandardAI, a San Francisco company that uses machine learning to detect the items purchased by students. Also in San Francisco was the birth of Zippin, a company founded by Krishna Motukuri and other former Amazon employees, which has developed technology of the same name based on AI algorithms, overhead cameras and sensors on the shelves that track products to spread shops that zero the queue for payment, effective even when crowded. Thanks to the cloud, moreover, retailers who choose Zippin (such as Fujitsu and Sberbank, Russia’s largest bank) don’t have to worry about servers and racks, thus greatly lowering the costs required to implement the solution, which outlines an Amazon Go-like experience for customers.

In Europe, the country most at the forefront of the segment is the UK, where in addition to the seven Amazon Fresh shops (different name but the concept is the same as Amazon Go) the first cashierless shops of Aldi, Tesco and Sainsbury’s have appeared. Sainsbury’s has opened its Sainsbury’s SmartShop Pick & Go in central London, a store to speed up supermarket shopping through an agreement with Amazon to integrate Just Walk Out technology. Product tracking, the process for entering the shop and the payment system are identical to those used in Amazon Go, but to access and shop you don’t need an Amazon account or a Prime subscription, but rather the Sainsbury’s SmartShop app, linked to the credit or debit card to which you will be charged.

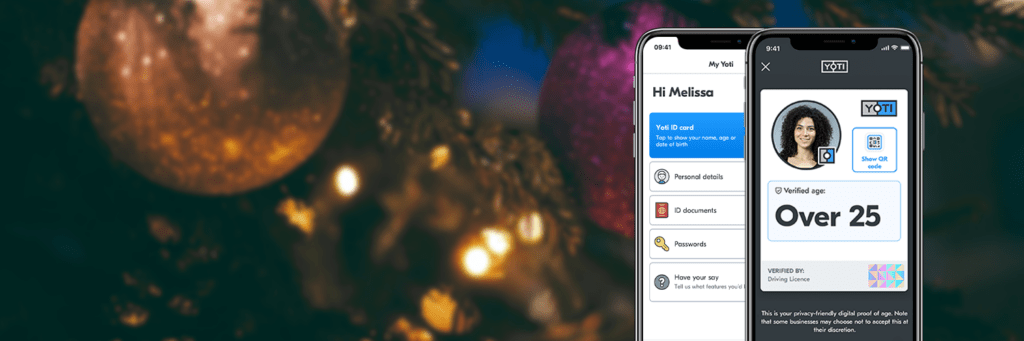

In the UK capital, Germany’s Aldi has also opened its first checkout-free supermarket. It is called Aldi Shop&Go and allows you to shop via the Aldi Shop&Go app. Unlike other supermarkets, to buy alcohol, cigarettes and other age-restricted products (such as knives) you have to use a facial recognition system to estimate your age. Also used by the National Health Service to assess whether a person is old enough to buy certain types of goods, the technology was developed by Yoti, uses a machine learning algorithm to check the age of analysed faces and, according to the company, reduces the likelihood of a 17-year-old getting through the system to 0.05%. Retailers can never see the photo being taken, and the process would not be able to link the face to an identity, a departure from facial recognition systems used for surveillance purposes. The UK government itself is advocating the use of technologies such as Yoti’s, and has called on tech companies, retailers and restaurants to find effective ways to verify customers’ identities. With this in mind, Aldi will test the technology until May 2022, deleting the photographs taken each time the identification process is completed. Customers who want to avoid verification, however, will be able to continue shopping by showing ID to the shop staff.

Behind the camera system at Aldi Shop&Go is AiFi, founded in California by Chinese Steve Gu and Ying Zheng, who condensed the best of their in-house technology into the AiGo shop in Shanghai, where around 200 cameras have been installed to monitor the more than 6,000 products on sale. AiFi is not a retailer, however, but a software company with a long list of committed partners. The list of innovative supermarkets includes two Carrefours in Dubai and Paris, PostNL in the Netherlands, where 20 Wundermart-branded supermarkets are due to arrive later, 17 outlets of the Polish low-cost market chain Zabka, which will grow to 25 in the coming months, and two dozen kiosks, restaurants and mini markets in US arenas.