The stock market crash of Meta, Facebook’s new company name, has recently caused a stir. In a single session, it ‘burned’ 80 billion dollars. That’s nothing if we consider that this year alone, the social network has plummeted by a good 660 billion, dropping to a capitalization of ‘only’ 240 billion. It was founder and major shareholder Mark Zuckerberg who paid the price. He slipped from the third richest man on the planet to position 23. He won’t starve, but at those levels, jealousies between billionaires are strong. In any case, Meta’s stock market crisis is far from isolated. It affects the entire FAANG index, as the stocks of the big Silicon Valley tech giants have been improperly known for years.

FAANG is an acronym for Facebook, Amazon, Apple, Netflix and Google. It has become somewhat of a telltale sign of the US stock market’s retreat. The S&P 500 index has lost almost 22% this year.

Much worse has happened to the giants, which at the beginning of 2022, were worth a total of almost 7.8 trillion dollars. At the end of the early November session, they lost just under 3 trillion. The collapse came after several years of a seemingly unstoppable run. Since the end of the recession caused by the Great Global Crisis of 2008 – this is early 2009 – Apple shares had exploded by 5,500%, Amazon by 5,700%, Alphabet (Google) by 1,600%, Netflix by 1,200%, and finally, Meta by 900% since its IPO in May 2012.

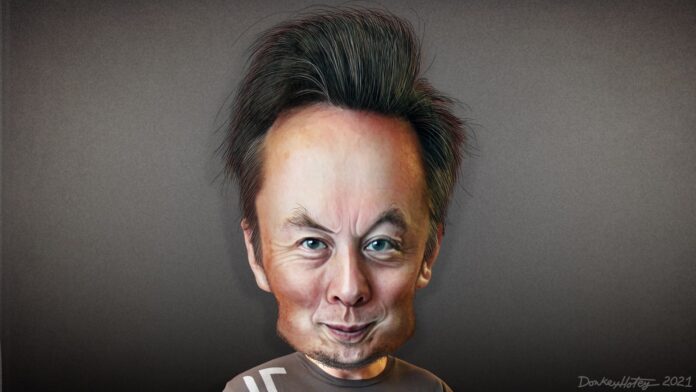

Months of declines on Wall Street with Silicon Valley’s biggies seeing their wealth shrink: according to many, the problem of the overwhelming power of the tech giants that weigh more than many states, from Google to Amazon, is resolving itself. Counter-evidence: the one that has done the most political and social damage, Meta-Facebook, has lost as much as 70% of its value in the past year. Things are not like that because, unlike the US monopolies of the 19th and early 20th century, which were related to circumscribed sectors of the economy (railways, oil, meat distribution), those of the 21st century are based on technologies capable of penetrating everywhere, changing society, information and politics, as well as the economy. This is especially not the case for the most eccentric, overflowing, but also a brilliant and capable figure of this new era Elon Musk.

A career of successes and provocations

Elon Musk is unprecedented in the history of capitalism. He loses tens of billions of dollars, but his power continues to expand: from cars to space, from clean energy to geopolitics and, now, even social networks to the world of information. Musk is also strong as an influencer, with 113 million followers (at the height of his media glory, Trump had 88) and considers himself above governments.

With his missiles and spaceships, he is now essential for US (also military) activities. With Starlink, he has more communication satellites than all the other countries of the world put together and is a significant player in Ukraine: this drives him to formulate outlandish peace proposals that make a desperate situation even more chaotic. He develops humanoid robots, rides on artificial intelligence, and with paid Twitter and fees for content creators, he could become a super-editor as he tries to impose his political and geopolitical agenda: things are never seen before. The White House and Pentagon fear that Elon Musk, impulsive and narcissistic, perhaps influenced by America’s adversaries (factories in China, projects in Russia), could become a national security vulnerability.

If Steve Jobs innovated the way of entrepreneurship through his ability to make marketing the cornerstone of a business, Musk would have done so by negating it; or rather and again, by transcending it. Elon Musk has, in fact, never advertised his products. On the other hand, he really didn’t need to because the real ‘product’ to promote is himself: his reputation is the fundamental asset of his companies. It is his reputation that is the fundamental asset of his companies. This move has allowed him to practically eliminate one of the biggest items of expenditure for any large company.

Social narcissism

To do this, Musk has jumped feet-first over almost every social and technological issue debated in recent years: from artificial intelligence to aliens, from workers’ rights to the Coronavirus. And he has done so in increasingly extreme and provocative tones and ideas, including declaring that Tesla’s shares were overvalued, claiming he wanted to sell all his possessions and that he wants to privatize the company by buying it for $420 a share and demonstrating that he apparently doesn’t know the difference between investments and market capitalization.

All these statements did not scare the public or investors at all – on the contrary – and Musk has recently become one of the most admired men in the world thanks to his latest achievements. Not least with the purchase of Twitter. In two days’ time, he has already caused a ruckus with his subscription to Blue for $8 a month, a prerequisite for getting the ‘certification check’. Genius or not, for now, he is right: he can continue this game indefinitely, as long as his business is talked about, for better or worse, and he gets what he wants: our attention.