CBDC: 105 countries are aiming to create their own digital currency: an analysis of the benefits and risks.

Cryptocurrencies have become so popular that every country has to think about creating its virtual currency, which is not intended to revolutionise the respective financial systems but rather to bring them up to date in a society that seems unable to give up the possibility of relying on a digital solution to complement traditional instruments. Everyone, or almost everyone, is now familiar with Bitcoin, Ethereum, and some other cryptocurrencies that are in vogue. Much less familiar is the average citizen with the path that national governments and international unions are pursuing in their interest in Central Bank Digital Currencies (CBDC). But what is it, what is it for, and what kind of changes could the development of this virtual currency bring?

CBDC

On a technical level, a CBDC is the digital form of a country’s fiat currency backed and issued by a central bank. Which conceptually stands at the antipodes of cryptocurrencies, based on the desire to decentralise the management of money, i.e., on a distributed ledger with which to verify the accuracy of every single transaction and thus bypass the control of a central body.

On the other hand, precisely because of the rapid rise of cryptocurrencies, beyond the crisis that has been sweeping the sector in recent months, the public-law credit institutions that manage the monetary policy of the various countries could not stand idly by in the face of the spread, risking letting the future of money slip through their fingers. Hence the need to create a digital alternative but still under the control of the central authority, be it political or economic. To summarise, one can refer to Cecilia Skingsley, the first woman deputy governor of the Sveriges Riksbank, the Swedish central bank, when she refers to the CBDC as ‘an evolution of the role of the central bank and not a revolution.’

Compliance and Privacy

Aiming to introduce a CBDC has several advantages, starting with the most obvious, the possibility to quickly and safely include citizens who do not yet have access to traditional financial services (such as a bank account). But increasing payment efficiency, reducing transaction costs, and providing a seamless flow of fiscal and monetary policy are also helpful options for any government. Then there is another aspect to be considered with the arrival of a programmable currency by nature, related to the opportunity for automatic transfers generated by predetermined scenarios and the enabling of products and services, not only financial, yet unseen that, as suggested by experts, could represent a paradigm shift at the monetary level.

Like any innovation that aims to improve the status quo, CBDCs also present risks and challenges to be overcome. First, the regulatory aspect concerns compliance with privacy, anti-money laundering, and consumer protection regulations. Another insidious factor is the potential vulnerability of the system, which can end up in the crosshairs of cyber criminals and therefore needs effective countermeasures. A potentially dangerous risk for countries with unstable financial and governmental systems is the increase in withdrawals from banks, which, in the event of a sudden, widespread and high purchase of CBDCs, could jeopardise the resilience of the entire system, putting the bank itself and the whole economy of the country in crisis.

Central Bank Digital Currency

With interest spreading globally over the past two years, there are currently 105 countries studying a plan to develop a Central Bank Digital Currency. To understand the growth in interest, it is sufficient to know that in 2020, only 35 governments were trying to figure out how to move towards the goal. The current scenario sees 11 countries that have launched their own digital currency, with Nigeria being the most popular case as it is Africa’s largest economy. The list also includes the Bahamas, Jamaica, and eight small Caribbean states: Anguilla, Saint Kitts and Nevis, Montserrat, Antigua and Barbuda, Dominica, Saint Vincent and the Grenadines, Saint Lucia, and Grenada.

After three years of study, in October 2021, Nigeria became the first African country to launch a CBDC. A virtual version of the official currency, the e-Naria, has the same value as the Naira but is held in a digital wallet and can be used for contactless payments in shops or to transfer money. The initial impact has been gradual, with about 700,000 users choosing to try e-Naira, a very small number in a country with 55 million active bank accounts.

According to Godwin Emefiele, head of Nigeria’s central bank, the reason stems from the opposition of the country’s credit institutions, which consider the fee-free digital currency a dangerous alternative to the financial services offered by the private banks themselves. However, the outlook leaves positive feelings, as Nigerians are among the leading proponents of cryptocurrencies (as evidenced by the action rates in recent years). In contrast, according to Gemini’s Global State of Crypto 2022 report, the national ownership rate has risen to 26%, with 63% of citizens looking at cryptocurrencies as the future tool of the financial world.

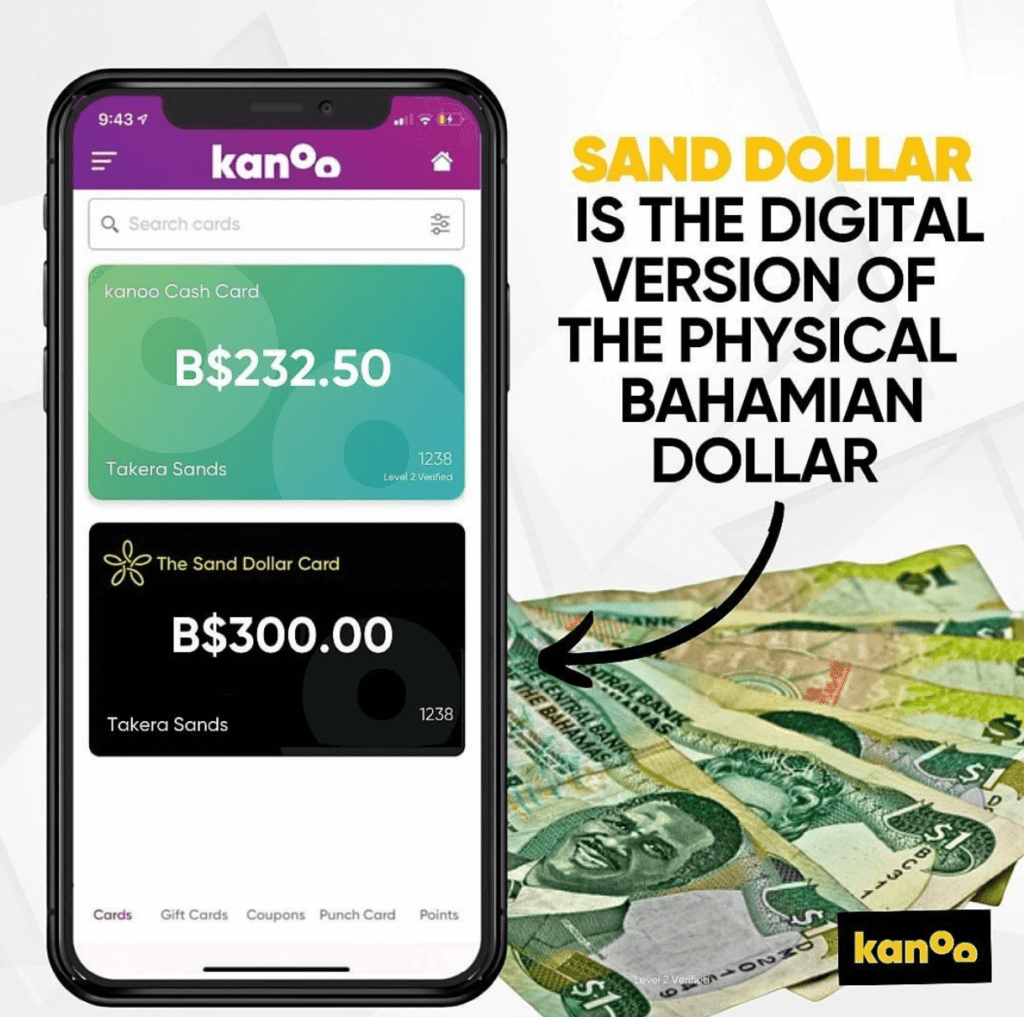

Sand Dollar

Before Nigeria, and any other CBDC, in October 2020 came the Sand Dollar, wanted by the central bank of the Bahamas to offer a convenient alternative to cash for citizens.

Initially confined only to the Exuma archipelago, where some 7,000 people reside, the digital currency was introduced in a second part of the territory before being rolled out nationwide to modernise the payments system and facilitate access to digital payments for all businesses to reduce untracked and untaxed activity.

The clearest advantage for most citizens brought by the Sand dollar was the possibility of no longer going to bank branches (a complicated movement due to the territory’s geography, made up of more than 700 islands). The opportunity was also a driver to accelerate the digitisation of government infrastructure to monitor government expenditure and revenue more effectively. The service provides two options: Tier I and Tier II are dedicated to private individuals, which differ in terms of limits on possession and monthly transactions, while Tier III concerns companies. However particular and limited, the Bahamas’ experiment remains a significant precedent that is a source of analysis for countries and multi-state unions.

Central Bank of Eastern Caribbean

Thanks to the action of the Central Bank of the Eastern Caribbean, Diamond Cash, the local dollar digital currency, has been adopted in the countries of the area, which allows for commission-free payments and can also be used by those who do not have a bank account.

Before talking about Europe, let us see what three of the most influential countries in the world, namely India, China, and Russia, have in mind. The Indian government aims to introduce the digital rupee over the next few months with a project run by the Serve Bank of India and aimed at reducing the system expenses for managing the currency and promoting an alternative to compete with the rising cryptocurrencies. The latter is not well-liked by the Indian government, which has repeatedly said it wants to discourage their spread within the country.

E-CNY

China is perhaps the experiment that the rest of the world is looking at with the most interest, not least because the digital yuan started being talked about in 2014, and the current E-CNY has been in the testing phase in the country’s major provinces for several months. With the predictable acceleration imparted by the Beijing Winter Olympics staged last February, transactions with the digital currency managed by the People’s Bank of China have exploded in recent months. The progression in using E-CNY is favoured by the Chinese authorities, who oppose the spread of Bitcoin and other cryptocurrencies. This is why digital money has been distributed on several occasions to promote the novelty and support consumption that has taken a nosedive due to the pandemic.

The Chinese vision is largely shared by Russia, which has announced in recent months that it is ready to launch the digital rouble. And to block any kind of cryptocurrency in any way (after a long diatribe and opposing decisions between Putin and the central bank), despite the fact that the Russians have always been among the biggest miners globally. For the time being, it is still permitted to buy, invest, and mine cryptocurrencies, but no payments can be made with private digital currencies.

Risks of Digital Currencies

The United States, on the other hand, is lagging with the executive order signed by President Joe Biden last March aimed at deepening the potential and risks of digital currencies. Among the objectives is the desire to create the digital dollar under the control of the Federal Reserve. There are a lot of talks, but few facts are yet to be seen, and we will have to wait to start seeing the first ones.

Certainly further ahead is the digital euro project, necessary, according to Christine Lagarde, to guarantee financial stability in the digital age that is making cash payments disappear. In this, too, the basic idea is to create a virtual currency managed by the European Central Bank that is accessible to everyone in the euro area, representing a supplement to and not a replacement for cash. It should be noted, however, that the version on which European insiders are focusing is not a currency intended for everyday use by citizens but a CBDC used in theory to manage transactions between banks and financial institutions, at least in the first test phase.